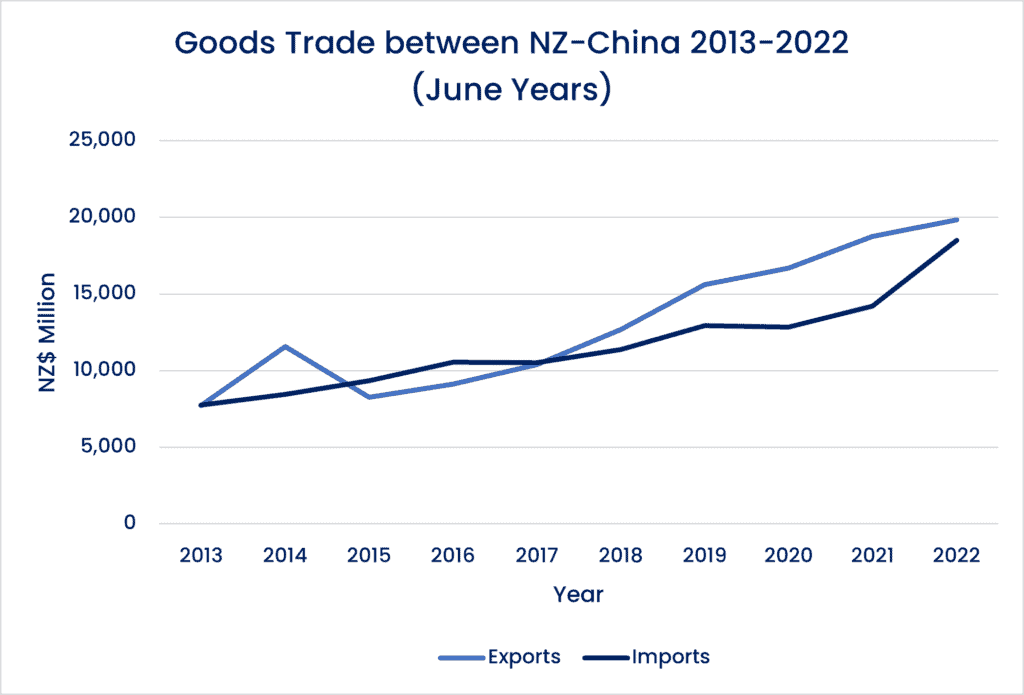

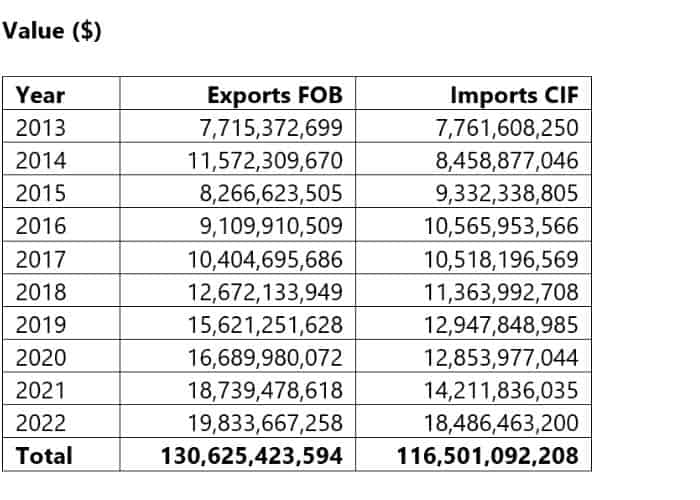

1 Data collated from Statistics New Zealand available at

https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=7bf54085-44d2-4d2b-b2dd-974dc0e6b2b4 and https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=2c877c7f-645d-474a-80a7-b48b2432586e

2 Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=7bf54085-44d2-4d2b-b2dd-974dc0e6b2b4

3 Statistics New Zealand available at https://infoshare.stats.govt.nz/TradeVariables.aspx?DataType=TIM and then retrieved from Exports, China, People’s Republic of and the individual HS Code headings table

4 Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=2c877c7f-645d-474a-80a7-b48b2432586e

5 Statistics New Zealand available at https://infoshare.stats.govt.nz/TradeVariables.aspx?DataType=TIM and then retrieved from Imports, China, People’s Republic of and the individual HS Code headings table

6 Retrieved from Ministry of Foreign Affairs and Trade : FTA upgrade available at https://www.mfat.govt.nz/en/trade/free-trade-agreements/free-trade-agreements-in-force/nz-china-free-trade-agreement/fta-upgrade/

7 Information retrieved from Understanding Chinese Investment in New Zealand, New Zealand China Council 2018 available at https://nzchinacouncil.org.nz/wp-content/uploads/2019/08/Understanding-Chinese-Investment-in-NZ.pdf, information supplied by companies in NZCTA China Business Award entries and NZCTA discussions/meeting notes.

8 Ibid

9 From Primary Collaboration New Zealand (Shanghai) Co., Ltd available at http://www.pcnz.com.cn/

10 Retrieved from Resuming Normal Service : Assessing future prospects for New Zealand – China services trade, Stephanie Honey : Honey Consulting Ltd, Commissioned by New Zealand China Council 2022, page 3, available at https://nzchinacouncil.org.nz/wp-content/uploads/2022/11/China-Services-Trade-Report.pdf

11 Data collated from Statistics New Zealand available at https://statisticsnz.shinyapps.io/trade_dashboard/

12 Retrieved from Resuming Normal Service : Assessing future prospects for New Zealand – China services trade, Stephanie Honey : Honey Consulting Ltd, Commissioned by New Zealand China Council 2022, page 3, available at https://nzchinacouncil.org.nz/wp-content/uploads/2022/11/China-Services-Trade-Report.pdf

13 Data collated from Statistics New Zealand available at https://statisticsnz.shinyapps.io/trade_dashboard/