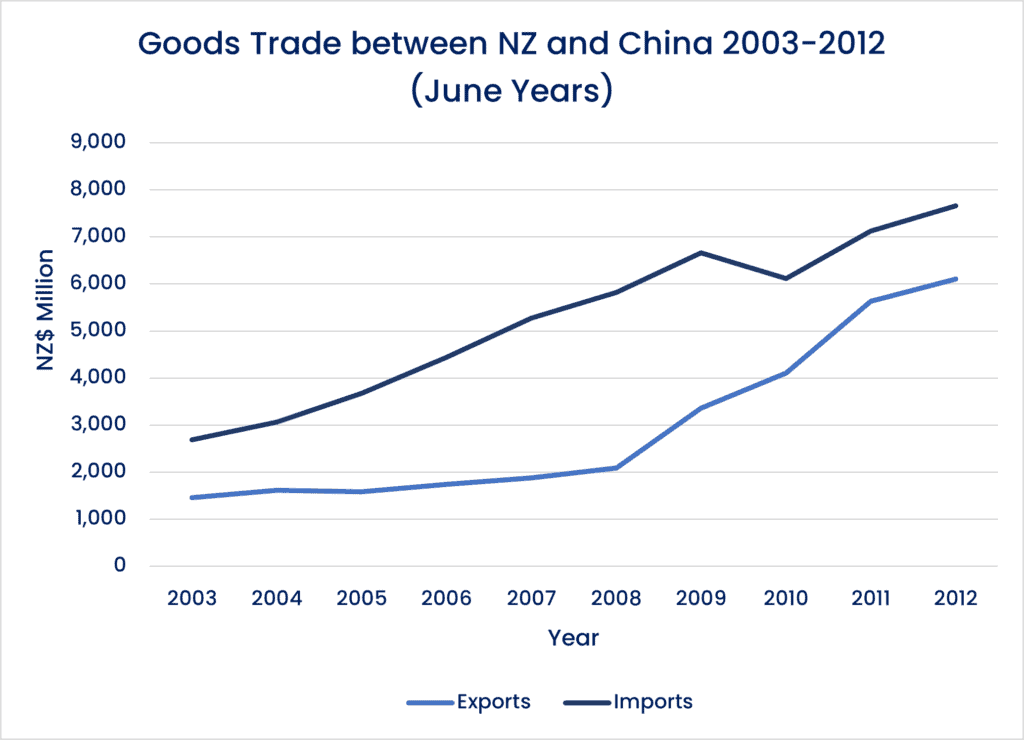

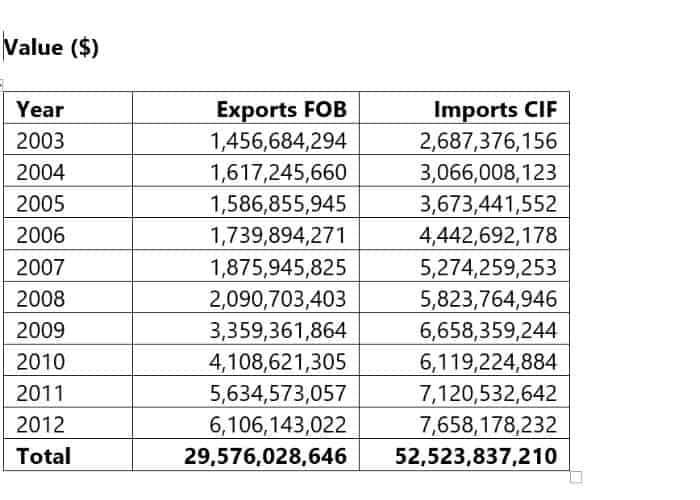

1 Data collated from Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=1cc53f2f-eb28-4052-9d0c-aa5bda75ad52 and https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=60482d74-712d-45a7-80ed-627a2c5bd77a

2 Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=1cc53f2f-eb28-4052-9d0c-aa5bda75ad52

3 Statistics New Zealand available at https://infoshare.stats.govt.nz/TradeVariables.aspx?DataType=TIM and then retrieved from Exports individual HS Code headings table

4 Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=5a1cc389-27dd-4886-a141-83692208f4b6

5 Statistics New Zealand available at https://infoshare.stats.govt.nz/ViewTable.aspx?pxID=60482d74-712d-45a7-80ed-627a2c5bd77a

6 Statistics New Zealand available at https://infoshare.stats.govt.nz/TradeVariables.aspx?DataType=TIM and then retrieved from Imports individual HS Code headings table

7 Alan Young, A major turning point from The Investment Conundrum Chapter in 40 Years On : New Zealand-China Relationships edited by Chris Elder (Victoria University Press 2013) pages 60-61

8 Ibid

9 From meetings, interviews and engagements with the companies listed, in Shanghai over 2007-2010 – J Shepherd, NZTE, Trade Commissioner in Shanghai

10 Ibid

11 Statistics New Zealand available at https://infoshare.stats.govt.nz/TradeVariables.aspx?DataType=TIM

12 Opening Doors to China, New Zealand’s 2015 Vision (Copyright New Zealand Trade and Enterprise (NZTE) and Ministry of ForeIgn Affairs (MFAT) 2012) page 1 and 15

13 See the impressions from Phillip Gibson – New Zealand Commissioner General for the 2010 Shanghai World Expo in the “Reflections on the Commercial Relationship 1973-2022” section

14 Statistics New Zealandhttps://cdn.livechat-files.com/api/file/lc/att-old/6093951/54f2876f38d1a6c65dc37fa3179d56bd/int-trade-in-services-by-country-yr-end-jun-2006-2013.xlsx

15 Ibid

16 From Tony Alexander and Charles Finny – Education and Education NZ in The Trade and Economic Relationship Chapter from 40 Years On : New Zealand-China Relationships edited by Chris Elder (Victoria University Press 2013) pages 38-40

17 Statistics New Zealand https://cdn.livechat-files.com/api/file/lc/att-old/6093951/54f2876f38d1a6c65dc37fa3179d56bd/int-trade-in-services-by-country-yr-end-jun-2006-2013.xlsx